IRA Implementation in the Electric Vehicle Battery Industry and the Clean Energy Transition

IRA Implementation in the Electric Vehicle Battery Industry and the Clean Energy Transition

ASBN’s Michael Green and Abby Maxwell had the opportunity to interview Jay Turner, a professor of environmental studies at Wellesley College and author of Charged: A History of Batteries and Lessons for a Clean Energy Transition. Since August 2022, Jay has been tracking the Inflation Reduction Act (IRA) incentives for clean energy, specifically focused on Electric Vehicle batteries, and what this means for business leaders and the energy transition more broadly. Recently, Jay summarized findings from his research in a Twitter thread that connects EV Batteries to IRA incentives and more broadly to the future of the clean energy industry in the United States. The below is a written summary of our conversation (not a transcript) from March 2023.

Why is this research important and what do we hope to learn from it?

Due to the historic investments in clean energy from the Inflation Reduction Act, there are numerous opportunities, along with several challenges, as these programs begin to be implemented. The Electric Vehicle and advanced battery industry is growing rapidly, and therefore is an important case study to examine the potential future of the clean energy industry in the U.S. As Treasury rulings begin to come out about how the department will interpret the language of the IRA, a massive amount of regulation will begin to shape what the future of the clean energy industry looks like. These rulings around sourcing of components and minerals is only the start of how this regulation will impact the domestic supply chains, as well as how the market will be set up to meet growing consumer demand for clean energy products and services.

Could you give a quick background on your academic career, how you came to the focus areas you have and what have you previously studied?

I currently teach environmental studies at Wellesley College. One class I teach is an introductory course on climate change that is geared towards an interdisciplinary audience of students. The course goes beyond the science of climate change, to consider it as a social and political challenge.

Batteries are an essential component of a clean energy transition. But few people know where batteries come from or what happens to them at end of life. The history of batteries, which I dive deep into in my newest book Charged, is important to a just and sustainable energy transition. It goes beyond the technical aspects of batteries to consider the social implications of the supply chains (including workers and frontline communities specifically).

Can you give a summary of your findings from your most recent research on EV batteries since the IRA was passed? What has the response been?

In writing Charged, I realized that while people in the U.S. focused on China’s investments in coal-fired power plants in the early 2000s, they overlooked the massive investment China was beginning to make in clean energy infrastructure – particularly with solar and batteries. While the media in the U.S. focused on individual companies like Tesla, China was busy building an entire clean energy supply chain. This helps explain why the IRA is important, as the US tries to play catch up to China.

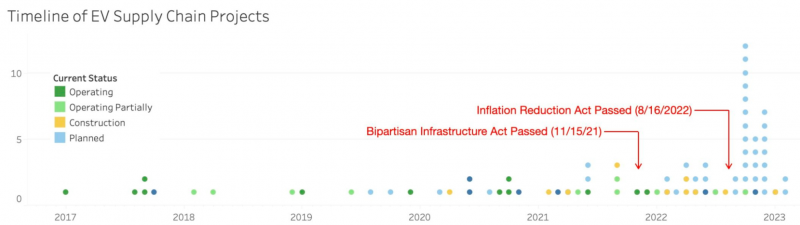

The blizzard of media coverage around the topic of U.S. clean energy investments started with the passage of the Bipartisan Infrastructure Law (BIL). As companies started projects for battery and component parts manufacturing, I began tracking these announced projects with the goal of understanding what was happening in the supply chain in the U.S. (and Mexico and Canada to a certain extent). I found that the rate at which manufacturers have responded since the IRA became law is astounding. This shows that the manufacturing sector is more nimble than the mining and processing industries at adapting to new policies and incentives.

Source: Twitter, @_Jay_Turner

Is there a connection between international trade and national policy and buildout of infrastructure? What has been the international community response?

As briefly mentioned above, the U.S. has been losing the competition in the lithium-ion battery industry. This goes back to China’s favorable policies for clean energy technology. While there was an effort from the Obama Administration early on to invest in advanced batteries, that push stalled in the early 2010s. It was at that moment that China doubled down on its investments in clean energy.

The IRA is a competitive move to shore up domestic clean energy technologies and is an attempt at making the U.S. competitive in this space again. This shift in the policy landscape has gotten the attention of the European Union. The IRA’s incentives do not extend to materials, batteries, or vehicles sourced from the EU. It is a measure of the success of the IRA that the EU is now looking to respond with similar policies.

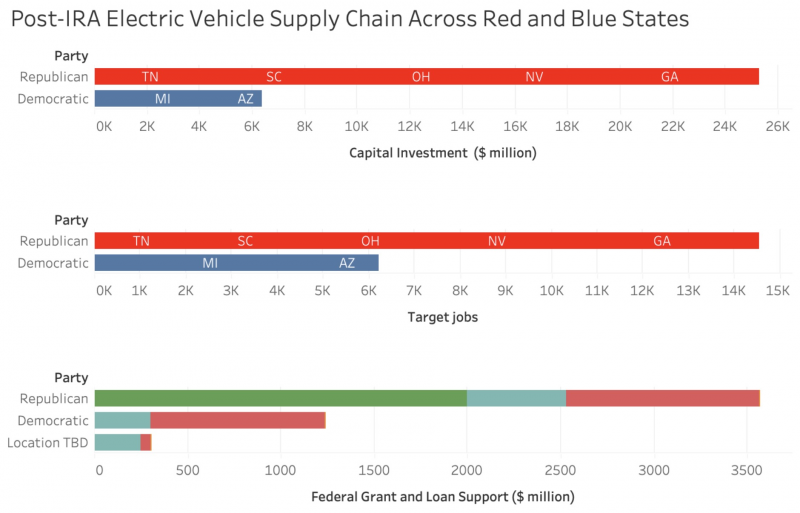

How do these findings connect to the larger clean energy transition? Specifically, could you discuss the finding that more red states are taking advantage of IRA funds than blue states?

There is not a clear answer but we can discuss a few possibilities. One reason could be that these states are traditionally thought of as “friendly to business.” On a practical level there is more space, access to transportation and raw materials, and existing labor policies are more favorable to scaling up manufacturing. The state level focus has been on uplifting the economic and labor benefits of the IRA and similar funding programs, rather than focusing on environmental benefits. The IRA makes up billions of dollars in incentives, and that is a big draw.

Source: Twitter, @_Jay_Turner

Zooming out, these findings have implications for the larger discussion on climate policy and clean energy transition. The year 2010 marked a low moment for U.S. climate policy with the death of the cap and trade bill. This was a result of the Tea Party and other groups organizing conservative states against cap and trade policies by focusing on the negatives that would personally affect individual constituents in these states. This narrative campaign derailed the climate agenda on a wide scale and massively decreased Congress’s support for investing in a clean energy transition in the 2010s. However, the IRA did not get politicized in the same way during the 2022 mid-term election, and thus represents an important shift in climate policy. The IRA does not focus on pricing carbon like some past attempts at legislation, but rather prioritizes and highlights the carrots – financial incentives and jobs. This difference in approach from past attempts at a climate agenda may be another reason why the IRA is being well received even outside of blue states. I am curious to continue exploring how this shift will affect climate politics more generally.

As a Follow up question: Are we going to see Republicans championing green economic growth? Is there a pivot or advancement?

Using the same pro-jobs and pro-manufacturing standpoint as was used with the IRA, I believe the numbers are there to support this theory. The investments in conservative states are so strong. The factories that will employ thousands of people have the ability to change the economic foundations in these areas. These investments usually occur in clusters in these areas, meaning that there is going to be space created for Republican legislators to move in this direction if they want to. There will be an ability to highlight the benefits brought to constituents in these areas. The energy transition is not about giving something up, but rather about gaining jobs and investment (as well as bringing about clean energy that benefits the environment). This alternative vision about climate change as an economic opportunity is critical.

It is important to remember that many of these communities do not necessarily want to be embedded in the fossil fuel industry, but that is traditionally where the opportunity has been. The IRA’s focus on domestic sourcing is a strong point.

What do you think is next in regards to the conversations about the IRA and clean energy? How can businesses be engaged?

The IRA is less than a year old, so there are many implementation questions that are still unanswered. For batteries specifically, I wonder how Treasury is going to assess whether companies are meeting the stringent sourcing requirements specified by the IRA*. As it stands now, it seems like any company tied to what is labeled as a “foreign entity of concern” is grounds for immediate disqualification. That is an area where many in the industry have questions. On a larger scale, there are questions about the specifics in every single IRA provision, so the answers to these may seem small but will collectively determine how impactful the IRA becomes. Another possible area for questions are the larger conversations around permitting reform and whether that will hold up projects further up the supply chain.

*Note: Since this interview was conducted in March 2023, The US Department of the Treasury has subsequently released a proposed guidance on the New Clean Vehicle Credit that was a part of the Inflation Reduction Act. The proposed guidance was released on March 31, 2023. This guidance, according to the Treasury, will “help ensure that American workers, companies, and consumers continue to benefit” from the $45 Billion in private sector investments announced across the clean vehicle and battery supply chain since the IRA was enacted.

To be eligible for a $7,500 credit, clean vehicles must meet sourcing requirements for both the critical minerals and battery components contained in the vehicle. Vehicles that meet one of the two requirements are eligible for a $3,750 credit. This ruling classifies constituent materials as critical minerals, therefore opening up more of the process to free trade partners, rather than specifically requiring US production, as opposed to the stricter requirements for battery components. More information on the requirements can be found here. This Catalyst podcast episode What the new Treasury rules mean for EV supply chains explains in more detail the importance of this ruling and what we may expect for future rulings.

As far as my research is concerned, the next steps are to continue to share new data on EV battery projects. How the auto industry responds to the IRA funding may dramatically change the industry as a whole.

Jay’s full research can be found here and will be updated as new developments emerge.

For more information about the Inflation Reduction Act, see ASBN’s website of resources here.

Comments

Post new comment